George Lorimer

Your Home Sold Guaranteed Or I'll Buy It!*

ProWest Properties,DRE# 01146839, *Conditions apply

|

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !

Real Estate Blog

Recent Posts

- San Diego Housing: Buyers Gain $100,000 in Buying Power as Inventory Rises

- San Diego Market Shift 2026: Buyers Gain Leverage Before Spring Inventory Spikes

- Are You Living in Your Ideal Home… or Just the Familiar One?

- San Diego Market Shift: Hot vs Cold Neighborhoods + Your ZIP Code Report

- San Diego more homes, better deals, see this weekend?

Categories

George Lorimers Real Estate Newsletter ( 131 )

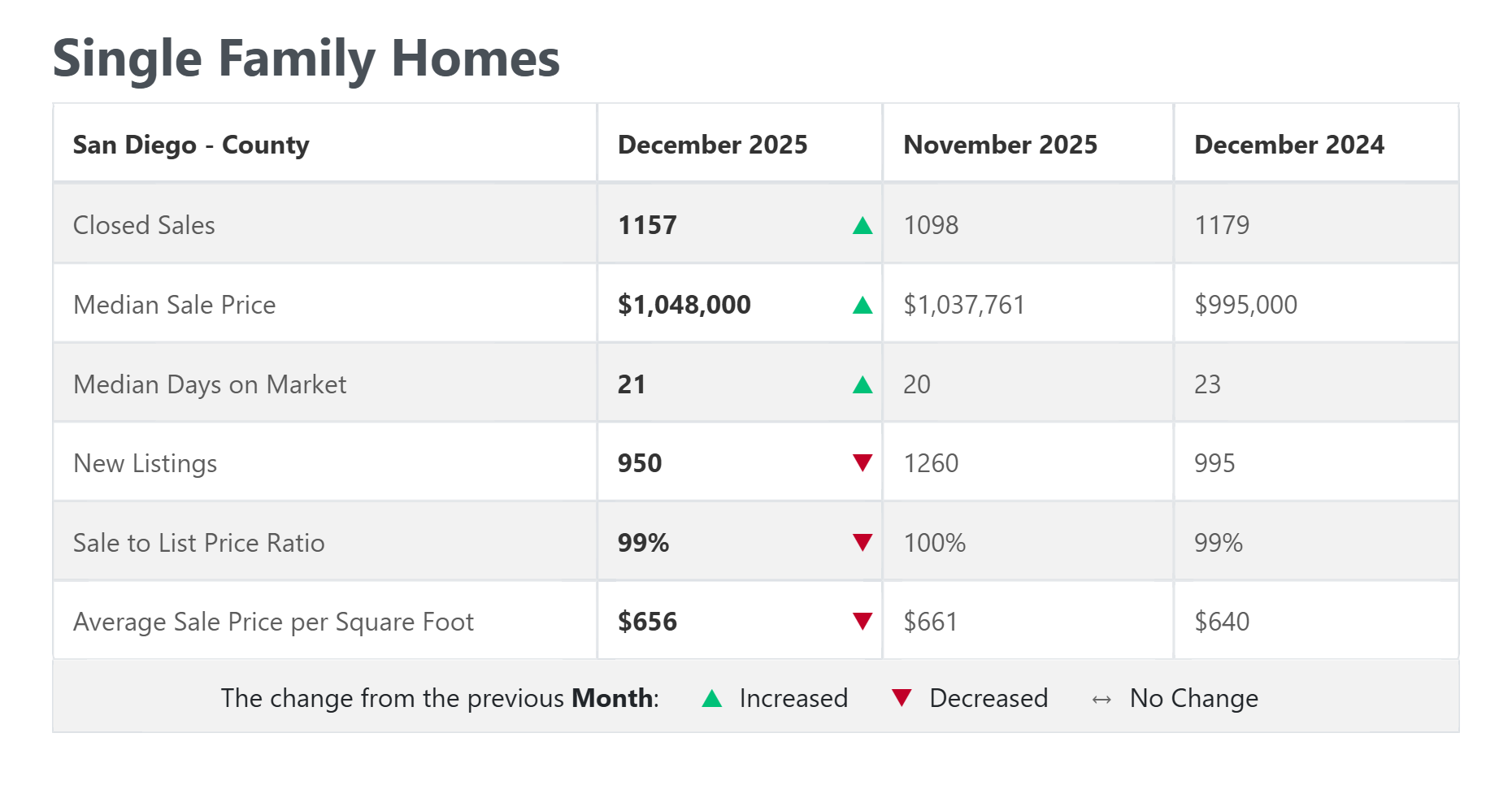

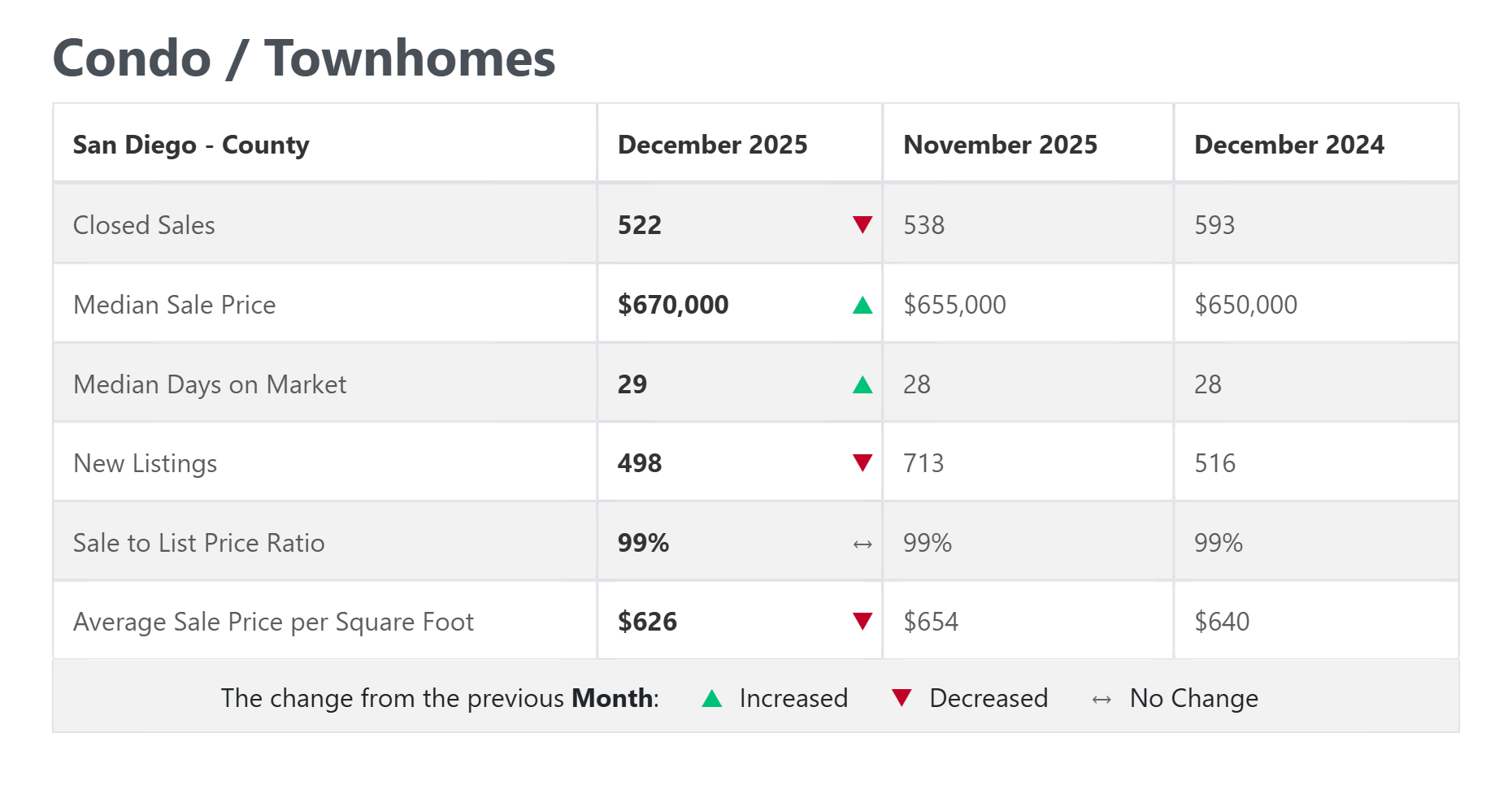

San Diego Market Statistics ( 105 )

San Diego Real Estate Listings ( 36 )

Archive